Demystifying White Label Wallet Solutions

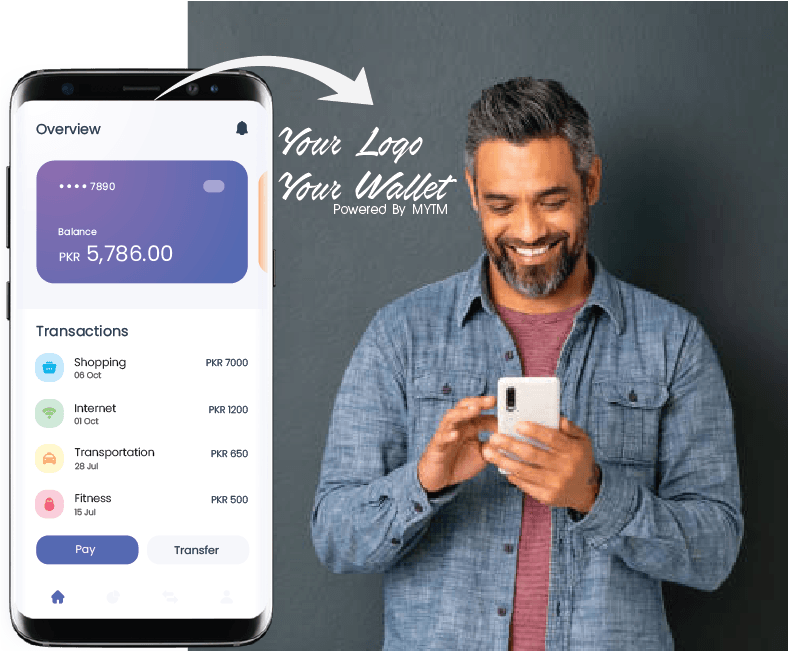

In the ever-evolving landscape of financial technology, White Label Wallet Solutions have emerged as versatile tools that empower businesses to offer branded, customizable digital wallets. These solutions are like a plain sheet of paper where businesses can create their own money services, and it’s faster and cheaper.

- Customization: White-label wallet solutions provide businesses with a blank canvas, ready for branding and customization.

- Efficiency: They reduce development costs and speed up the launch of financial services, making them accessible to businesses of all sizes.

- Security: With robust security features, these wallets ensure the safety of financial data and user information.

- User Experience: User-friendly interfaces make these solutions ideal for delivering a seamless experience to customers.

The Versatility of White Label Wallet Solutions

These solutions cater to businesses across various industries, from startups to established enterprises. No matter what kind of business you have, using white-label wallets has many good things about it.

- Adaptability: White-label wallets adapt to the specific needs and branding of your business.

- Cost-Effectiveness: They provide a cost-effective way to enter the digital finance market.

- Security: Security features build trust among users.

- Scalability: The wallets grow with your business, accommodating an expanding user base.

Unlocking Financial Inclusion

White-label wallet solutions play a crucial role in expanding financial inclusion by reaching unbaked and under banked populations worldwide. These wallets provide accessible and affordable financial services.

Special Points:

Global Reach: Businesses can extend their reach to underserved regions, contributing to economic growth.

Mobile Accessibility: Mobile wallets make transactions and financial management accessible via smartphones.

Diverse Services: A range of services, from simple payments to microloans, cater to diverse financial needs.

Regulatory Compliance: Adherence to local financial regulations ensures trust among users and authorities.

Integration and Future-Proofing White Label Wallet Solutions

White-label wallet solutions seamlessly integrate with existing systems and adapt to emerging technologies, ensuring long-term viability.

Features

API Integration: Integration with websites, apps, and backend systems enhances user experience and data flow.

Blockchain Integration: Incorporating blockchain and crypto currencies attracts tech-savvy users.

Data Analytics: User data can be analyzed for informed business decisions, and optimizing wallet performance.

Adaptability: These solutions can accommodate emerging technologies like AI and IOT, staying relevant in the dynamic digital landscape.

Now, let’s delve deeper into the world of White Label Wallet Solutions, exploring their features, benefits, and real-world applications.

Section 1: Features and Functionality White Label Wallet Solutions

White-label wallet solutions come equipped with a rich set of features that cater to businesses across industries. Some of these key features include:

Branding: The ability to customize the wallet’s appearance and user interface with your company’s branding elements.

Multi-Currency Support: Support for multiple currencies, enabling international transactions.

Security Protocols: Robust security measures, including encryption and authentication, to protect user data.

Payment Processing: Integration with various payment gateways for seamless transactions.

Account Management: Features for users to manage their accounts, view transaction history, and set preferences.

Customer Support: Options for providing customer support and resolving issues within the wallet interface.

Section 2: Benefits for Businesses

White-label wallet solutions offer a plethora of advantages for businesses looking to enter the digital finance space. Now, let’s look closely at these good things.

Cost Efficiency: Developing a wallet from scratch can be expensive and time-consuming. Using ready-made solutions like white-label ones saves a lot of money and helps you get things done faster.

Reduced Risk: Leveraging a pre-built solution minimizes the risks associated with software development, ensuring a smoother launch process.

Brand Visibility: Customizable branding allows businesses to reinforce their brand identity and gain visibility among users.

User Retention: Offering a convenient and secure financial tool enhances user retention and loyalty.

Competitive Edge: Quick deployment of wallet services gives businesses a competitive edge in the market.

Section 3: Real-World Applications White Label Wallet Solutions

White-label wallet solutions find applications in a wide range of industries. Here are some real-world examples:

Retail: Retailers can offer loyalty programs, discounts, and mobile payments through branded wallets.

Banking: Banks can expand their digital offerings with personalized, secure wallets.

E-commerce: E-commerce platforms can streamline online shopping experiences with integrated payment solutions.

Travel: Travel companies can offer digital travel wallets for booking flights, hotels, and activities.

Government: Governments can provide citizens with secure wallets for receiving benefits and making payments.

Section 4: User Adoption and Engagement

To ensure user adoption and engagement, businesses must continually improve their white-label wallet solutions. Here are additional strategies to consider:

Feedback Loops:

Create feedback loops that allow users to provide suggestions and report issues directly within the wallet. This proactive approach shows users that their input is valued and can lead to iterative improvements.

Gamification:

Make using the wallet more fun by adding things like prizes, stickers, or fun games. Gamification can foster a sense of achievement and encourage regular usage.

Educational Content:

Develop educational content within the wallet to help users make the most of its features. Video tutorials, FAQs, and in-app guides can empower users to explore and utilize all available functionalities.

Community Building:

Establish a user community or forum where users can interact with each other, share tips, and discuss their experiences. A thriving community can promote user loyalty and peer-to-peer support.

Personalization:

Implement personalization features that tailor the wallet’s content and recommendations to each user’s preferences and behavior. Personalization enhances user satisfaction and retention.

Transition

More people will use their customized wallet when firms take actions that delight their customers, and those customers will actually enjoy using it for their financial demands.

Section 5: Key Considerations for Implementation

Implementing a white-label wallet solution requires a well-thought-out strategy. Here are more things to think about to make sure everything goes well.

User Onboarding:

Develop a seamless onboarding process to guide users through setting up their wallets. Making it easy for people to start using something can make them very happy.

Security Audits:

Conduct regular security audits and penetration testing to identify and rectify vulnerabilities. Keeping user data safe is paramount for trust and compliance.

Compliance Updates:

Stay up-to-date with evolving financial regulations and ensure that your wallet solution complies with all applicable laws and standards. Non-compliance can lead to legal issues and loss of trust.

Scalability Planning:

Plan for scalability from the outset. As your user base grows, your white-label wallet solution should seamlessly accommodate increased traffic and transactions.

Data Privacy:

Clearly communicate your data privacy policies to users and obtain their consent for data collection and processing. Transparency builds trust and ensures compliance with privacy regulations.

Section 6: Case Studies

Now, let’s look closely at some examples to see how companies used special wallets to do well.

Case Study 1: Retailer X

Store X did really well with their special wallet. They made customers like them more, sold more stuff, and learned important things about their customers. They applied what they learned to create better advertisements and products to sell, increasing their revenue.

Case Study 2: Bank Y

The simple-to-use unique wallet offered by Bank Y attracted a variety of clients, not simply young people. By offering educational resources and personalized financial tips within the wallet, Bank Y positioned itself as a trusted financial advisor, enhancing customer loyalty.

Case Study 3: E-commerce Giant Z

E-commerce By incorporating cutting-edge technology like augmented reality (AR) for virtual try-ons and voice-activated purchasing, Giant Z continued to reinvent their white-label wallet. These enhancements not only made customers happier but also elevated the business to the top of the online retail sector.

Section 7: Conclusion

- To sum it up, White Label Wallet Solutions are like versatile tools that can change how businesses provide financial services. Fintech is important because it makes money services better for everyone by making them just right, saving money, and letting more people use them.

- By understanding your audience, harnessing the right technology, and prioritizing user experience, you can unlock the full potential of these solutions and drive your business forward in the digital age.

- As you embark on your journey to implement and optimize a white-label wallet solution for your business, remember that it is not a one-time effort. Continuous improvement, user engagement, and staying attuned to industry trends are key to ensuring that your white-label wallet remains a competitive and indispensable part of your business strategy.

- In the dynamic landscape of financial technology, the possibilities are endless.